Melbourne’s unit prices are at a record high but are set to blow out even further this year as young buyers abandon their dreams of a house and turn to apartments instead.

Melbourne’s median house price soared past $1 million in the June quarter, defying the pandemic to set a record and raising fresh fears over housing affordability.

Units also hit a record price, rising to a median of $572,793.

While the cost of a unit sits at nearly half that of a house, experts say affordability issues will force many in the market, particularly first-home buyers, to purchase apartments rather than houses, which will then drive unit prices higher again.

Domain chief of research and economics Nicola Powell said the higher house prices climbed, the more demand would flow into units.

“Some people are forced to buy a unit in their designated suburbs,” Dr Powell said. “It’s about them getting that first rung on the ladder and it has to be a unit because house prices are so high.”

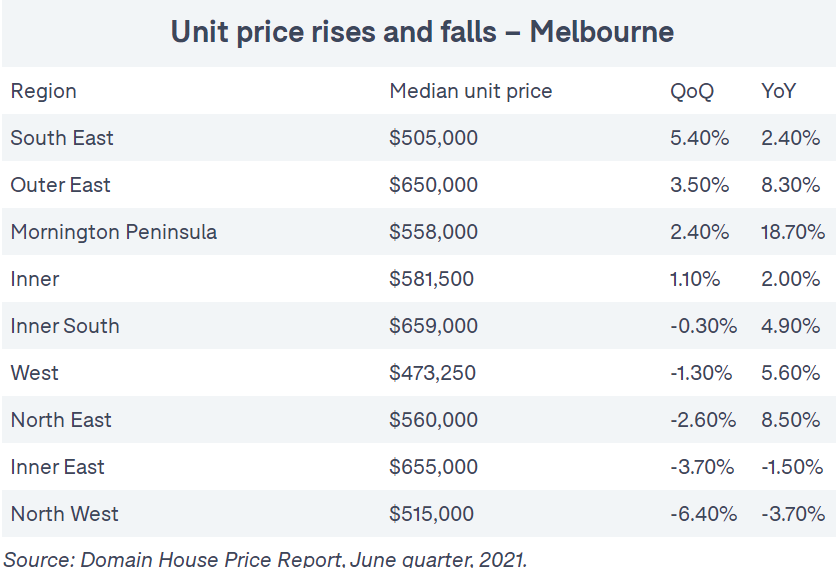

All but two of the Melbourne regions registered unit price increases over the past year, particularly in the north-east (up 8.5 per cent) and the outer-east (up 8.3 per cent). Units on the Mornington Peninsula skyrocketed by 18.7 per cent over the year to June.

And while the price gap between units and houses is considerable now, Dr Powell said, it’s likely to narrow, not just because of priced-out home-buyers turning to apartments but also because of a projected shortage of units in general.

The expected return of international buyers that will coincide with falling apartment approvals and commencements will mean a shortage of apartments, meaning higher prices.

“I’m actually quite concerned about the impact on housing demand once we see international borders reopen,” Dr Powell said.

“There is a skills shortage … and if there’s a focus by the government on population growth and bringing skilled workers back added to the delayed construction cycle it’s going to be interesting to see what happens.”

AMP Capital chief economist Shane Oliver said we could see an oversupply of houses in the market in the future as the federal government’s Home Builder incentive had resulted in a record number of homes being built.

“I think we could see a reversal of what the market was doing a few years ago. That will be an undersupply of units and an oversupply of housing pushed along by the demand from Home Builder,” Dr Oliver said. “Approvals for units [being built] have fallen right away at the same time.”

For those looking to sell units, the turnaround in prices has been a small miracle, especially in areas where prices had been hit hardest by the pandemic last year.

The Inner Melbourne region, which includes the suburbs of Carlton and Brunswick, saw prices suffer as students attending nearby universities and other renters, including hospitality workers, moved back home.

However, unit prices there turned around in the June quarter and rose by 1.1 per cent. It was a bounce back from the drop in prices by 2.6 per cent in the March quarter.

It’s excellent news for Mia Jardon and her partner Brent White, who are selling their two-bedroom unit in Brunswick West.

The couple are looking to buy a house – specifically a fixer-upper – somewhere nearby, though they admit it may be hard to find something they can afford.

“We’re ready to move on to the next chapter of our lives because we have a 20-month-old girl and she’s outgrown this place,” Ms Jardon said.

The couple said they had been looking at the market for a while and were hopeful they would be able to sell their renovated unit for a decent price, despite the pandemic.

“I’m a little bit nervous if our home is sold and we may not have somewhere to move to straight away,” Ms Jardon said. “We’re hoping for a short settlement and plan to go really aggressively at auctions.”

Ray White Brunswick selling agent and auctioneer Alex Ilyin said he was now struggling to find stock of both houses and units for sale.

Mr Ilyin said both first-home buyers and transitional buyers – that is, those who owned a smaller apartment and were looking for something bigger – were wanting to buy units like Ms Jardon and Mr White’s.

“I’m finding that demand is really outstripping supply at the moment,” he said.

Buyer’s advocate Cate Bakos said buyers, including first-home buyers and investors, were now returning to units as Melbourne recovered from the pandemic and got used to the ongoing lockdowns.

“We’re now seeing more acceptance of units as Melbourne’s recovery continues from COVID-19 and people are getting used to coming back to work [in between lockdowns],” Ms Bakos said. “Workplaces are coming back and are more easily able to pivot as well.”

Market Cooperate

China:

Address:Level 15, No. 28 Freshwater Place Southbank VIC 3006

Email:lian@shaircommerce.com

Mob: 0426 272 788

Melbourne:

Cobyright:Shair Commerce Group Pty Ltd Copyright 2018 ICP license:沪ICP备14047693号-3

Tel :

03 9982 4553

Tel:+86 13918227857

Email:gracezhao@shaircommerce.com

Map